UK Bank Exchange Rates

BANK ACCOUNTS IN THE UK – GBP MONEY TRANSFER RATES

Evaluate British bank UK pound exchange rates and find a better deal when sending overseas money to your bank account in the UK or when transferring money abroad.

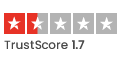

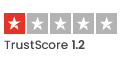

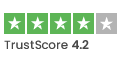

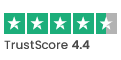

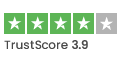

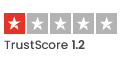

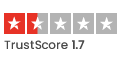

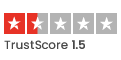

| UK Bank Exchange Rates | GBP to EUR | GBP to USD | GBP to AED | TrustScore (Trustpilot) | More Details |

|---|---|---|---|---|---|

| Barclays Bank | €1.154 | $1.25 | Dhs4.59 |  |  |

| Cater Allen Bank | €1.15 | $1.246 | Dhs4.576 |  |  |

| Clydesdale Bank | €1.17 | $1.268 | Dhs4.657 |  |  |

| CO-OP Bank | €1.149 | $1.245 | Dhs4.571 |  |  |

| First Direct | €1.14 | $1.236 | Dhs4.537 |  |  |

| Halifax Bank | €1.157 | $1.254 | Dhs4.604 |  |  |

| HSBC | €1.151 | $1.247 | Dhs4.58 |  |  |

| Lloyds Bank | €1.14 | $1.236 | Dhs4.537 |  |  |

| Metro Bank | €1.14 | $1.236 | Dhs4.537 |  |  |

| Monzo Bank | €1.182 | $1.281 | Dhs4.705 |  |  |

| M&S Bank | €1.14 | $1.236 | Dhs4.537 |  |  |

| Nationwide | €1.17 | $1.268 | Dhs4.657 |  |  |

| NatWest Bank | €1.145 | $1.241 | Dhs4.557 |  |  |

| RBS | €1.142 | $1.237 | Dhs4.542 |  |  |

| Santander Bank | €1.144 | $1.24 | Dhs4.552 |  |  |

| Standard Chartered Bank | €1.14 | $1.236 | Dhs4.537 |  |  |

| Starling Bank | €1.188 | $1.288 | Dhs4.729 |  |  |

| TSB Bank | €1.14 | $1.236 | Dhs4.537 |  |  |

| Yorkshire Bank | €1.17 | $1.268 | Dhs4.657 |  |  |

Popular UK bank accounts

Lloyds – One of the oldest and most well-known banks in the UK, offering a range of current accounts with various benefits and features.

Barclays – Another major player in the UK banking industry, known for its innovative digital banking services and diverse account options.

NatWest – A popular choice for many UK residents, offering a variety of current accounts tailored to different customer needs.

HSBC – A global bank with a strong presence in the UK, offering a range of current accounts with international banking capabilities.

Santander – Known for its competitive interest rates and cashback offers, Santander is a popular choice for those looking to maximise their savings through their current account.

Euro transfers to or from the UK

Euro transfers to or from the UK have become increasingly common as more businesses and individuals engage in international transactions. With the UK’s decision to leave the European Union, there has been uncertainty surrounding the future of Euro transfers.

However, many financial institutions and online transfer services still offer competitive rates and efficient processing for Euro transfers to and from the UK. As businesses continue to operate across borders and individuals travel for work or leisure, the need for seamless euro transfers remains crucial in today’s global economy.

If you are a UK expat living abroad, you may find yourself needing to transfer money back to the UK for various reasons, such as paying bills, sending money to family members, or making investments. However, not all countries offer the same ease and cost-effectiveness when it comes to money transfers.

For UK expats living in Europe, countries such as Spain and France are also good options for money transfers. With a high number of expats from the UK living in these countries, there are many services available that cater specifically to their needs. Popular options include TransferWise, XE, and Revolut, which offer competitive exchange rates and low fees for transferring money back to the UK.

Overall, the key factors to consider when choosing a money transfer service as a UK expat living abroad are exchange rates, fees, and reliability. By doing your research and comparing different services, you can find the best option for transferring money back to the UK from your country of residence. Whether you are living in the US, Australia, Europe, or elsewhere, there are many options available to make the process quick, easy, and cost-effective.

UK Bank Branch Finder

Find British Bank branch addresses near you with our geolocation map search. Simply enter the bank name (and optionally a city or country) and the map will display the closest bank branches in your search area results.

Still have questions regarding UK bank rates and charges?

All UK bank exchange rates, fees and charges can vary depending on the currency being exchanged and daily market fluctuations.

It’s a good idea to compare exchange rates between your bank and money transfer providers to ensure you are getting the best deal possible when making international currency payments to or from a British bank account.

Doing some research and evaluating options will ultimately save you time and money: Compare money transfer providers